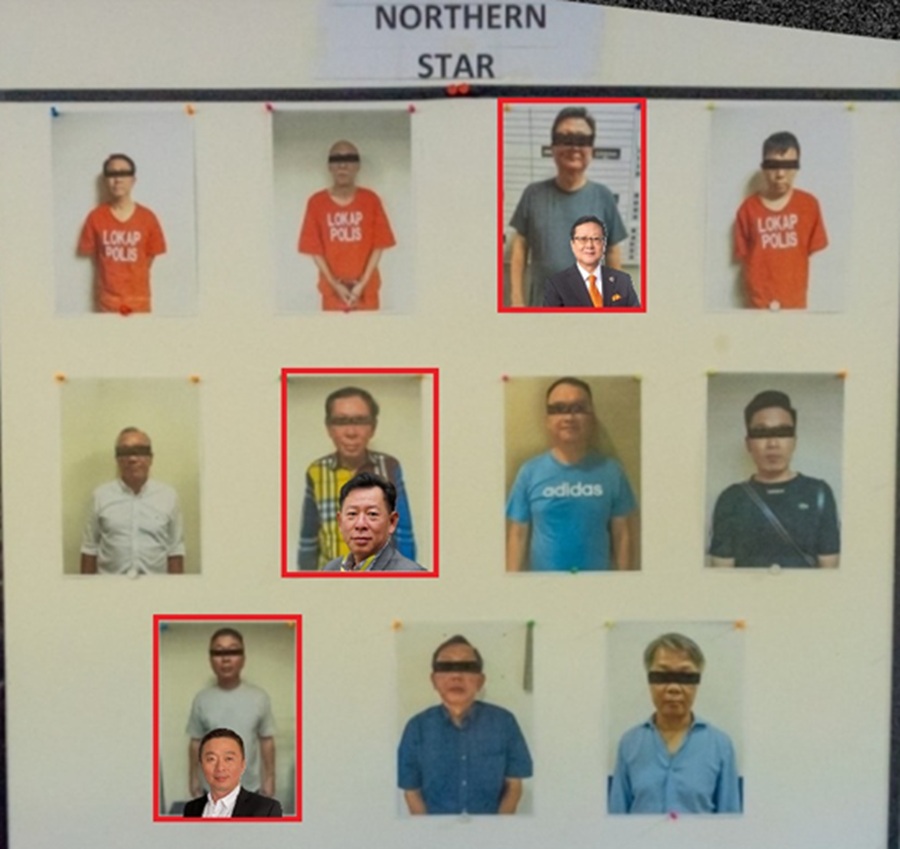

The chain of investigations into the illegal investment scheme MBI International has continued to rattle Malaysia’s capital market, beginning with the arrest of Tan Sri Kean Soon, Deputy Chairman of T7 Global Bhd, in April this year. That high-profile detention opened a new wave of revelations – exposing how MBI’s illicit funds were funneled into publicly listed companies and implicating some of the most prominent figures in Malaysia’s corporate world.

RM25 Million, High-Profile Arrests & Big Corporate Names

Earlier reports revealed that some RM25 million was moved by MBI’s close associates – including Datuk Seri Chiau Beng Teik (Chin Hin Group) and Datuk Keh Chuan Seng – supposedly to secure the release of MBI founder Tedy Teow. Out of that sum, only RM10 million was allegedly paid to Tan Sri Kean Soon. The plan ultimately failed and instead ensnared Tan Sri Kean Soon himself.

Following that, the name of Tan Sri Alex Ooi also surfaced, before the probe widened to other high-profile figures, including:

- Tan Sri Dato’ Dr Khor Eng Chuen – Chairman of ECK Development Sdn Bhd, developer of the Kulim International Airport (KXP); notably, Tedy Teow’s son was a partner in ECK Development.

- Dato’ Sri Lee Hock Seng – Magma Group Berhad

- Dato’ Low Eng Hock – Ivory Properties Group Berhad

- Dato’ Lee Foo San – Watta Holdings Berhad

- Goh Choon Lye – former figure of ACME Holdings Bhd

This list underscores that MBI’s network has penetrated listed companies and no longer operates merely on the fringes of the financial system. Their operations appear coordinated and highly calculated.

Who’s Next?

New Focus: Datuk Keh Chuan Seng & Andrew Tan

In previous disclosures, Datuk Keh Chuan Seng’s name often appeared as a close business partner of Datuk Seri Chiau Beng Teik, though it was rarely addressed openly.

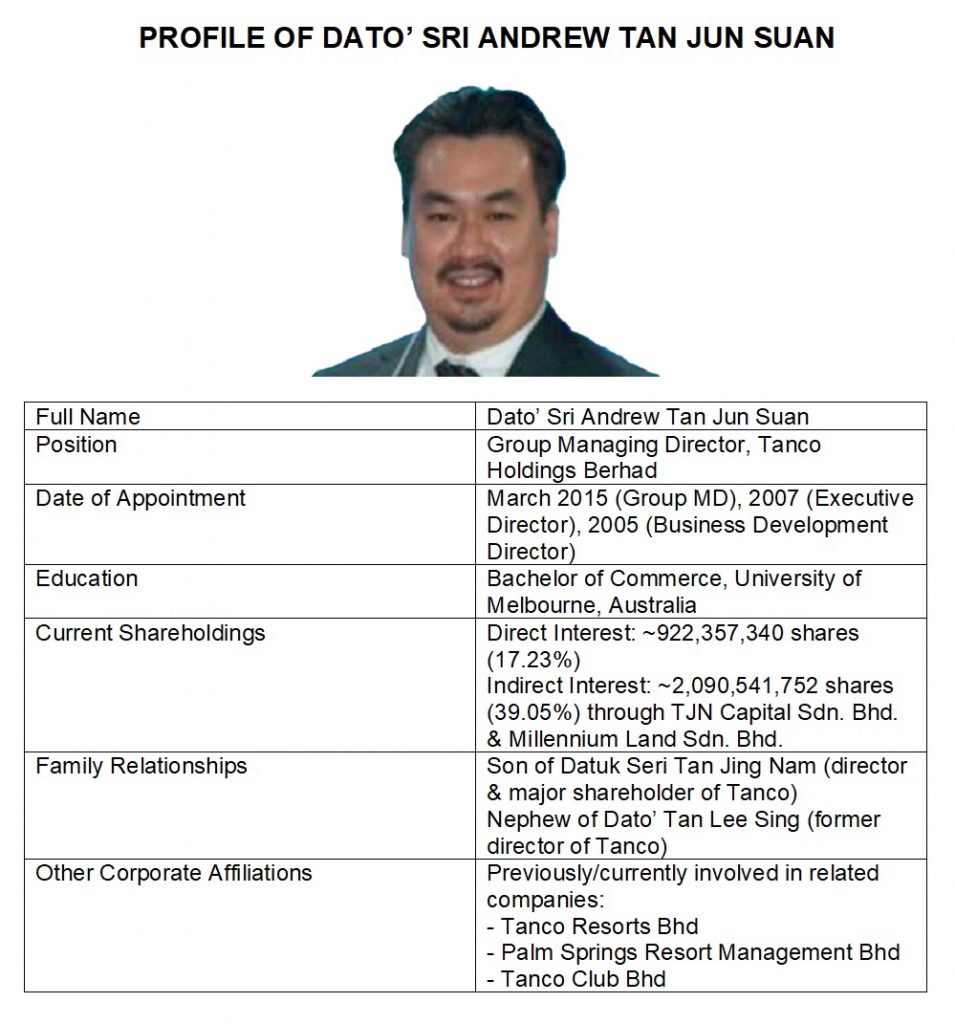

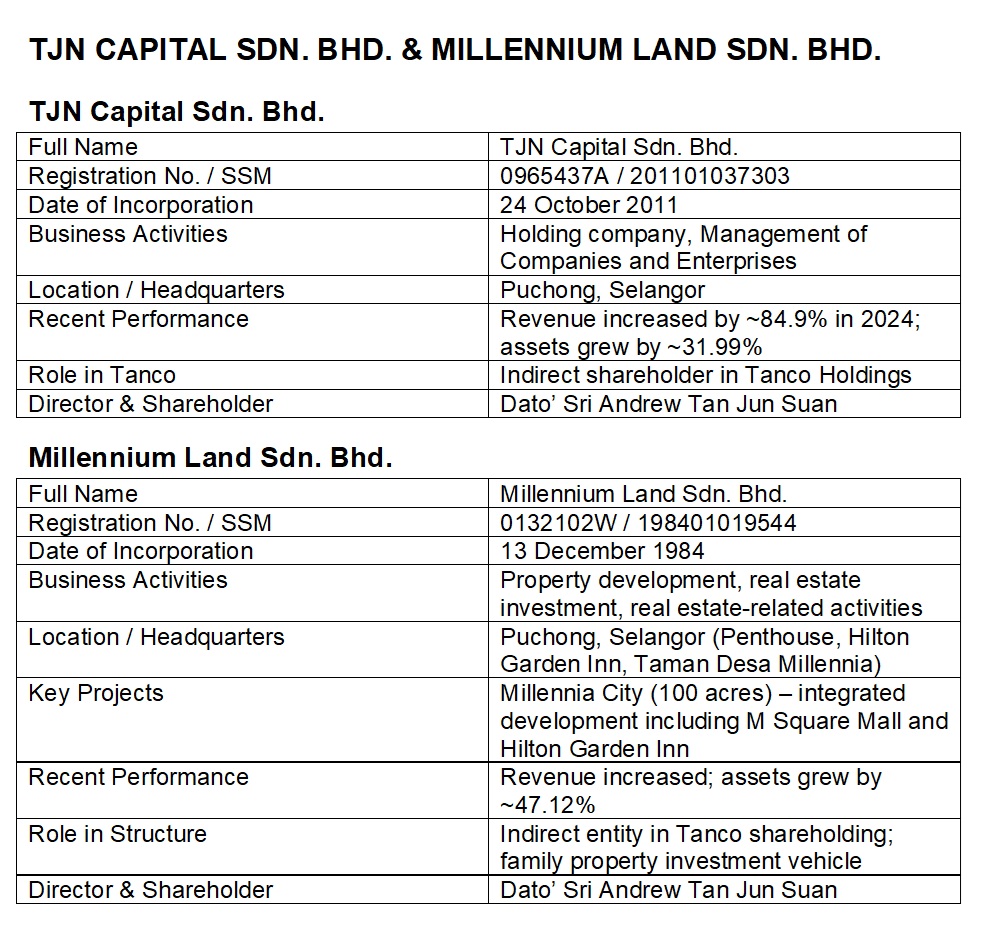

Now, the spotlight has shifted to him – alongside Dato’ Sri Andrew Tan Jun Suan, the Group Managing Director of Tanco Holdings Bhd.

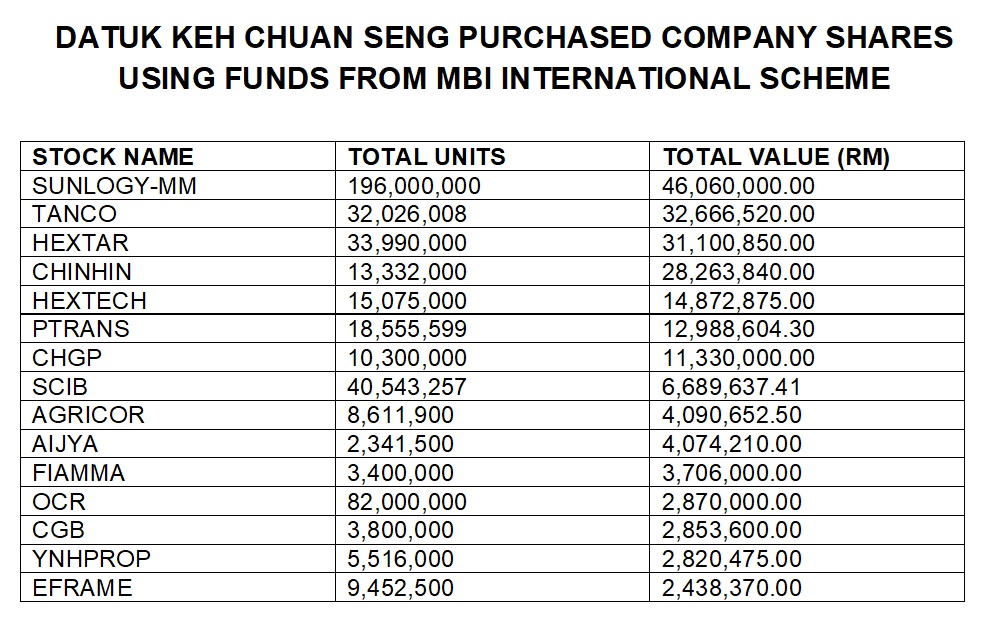

- Datuk Keh Chuan Seng is alleged to have acted as a key architect in laundering MBI’s illicit funds – by acquiring shares in listed companies using money sourced from the scheme.

- Dato’ Sri Andrew Tan, meanwhile, is seen as a beneficiary – with those funds allegedly flowing into Tanco Holdings to bolster the company’s standing on Bursa Malaysia.

Profile of Datuk Keh Chuan Seng

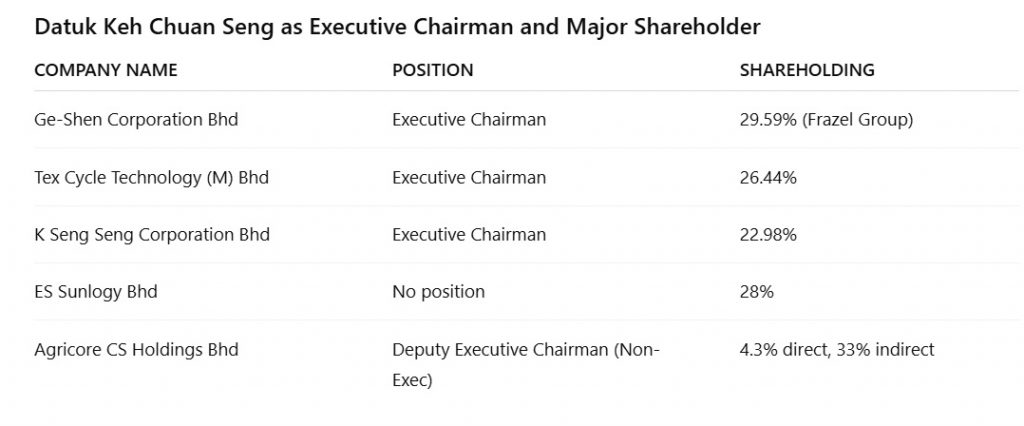

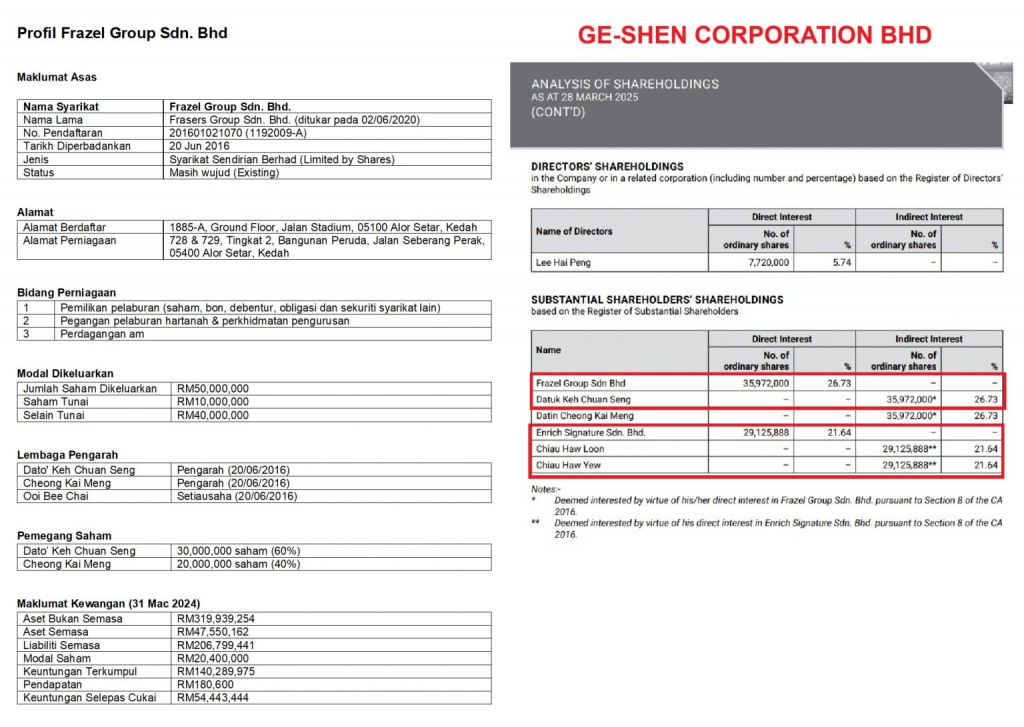

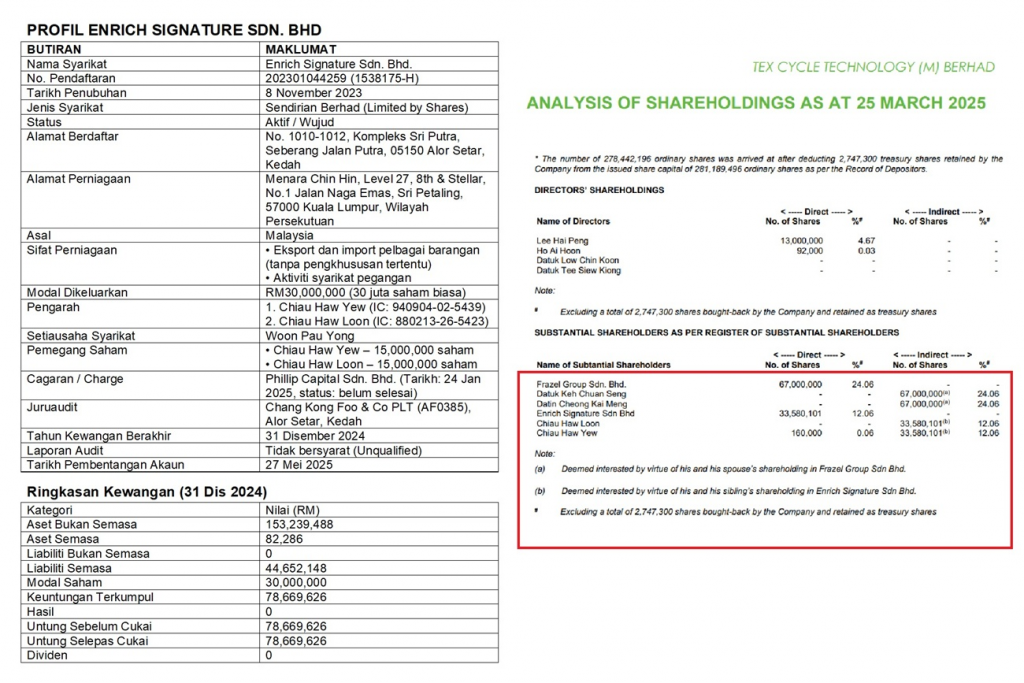

Datuk Keh is no small name. He is a prominent investor in Bursa-listed companies, with influence spanning the manufacturing, stainless steel, and waste management sectors. Through his private investment firm, Frazel Group Sdn Bhd, he has held significant stakes in several major entities.

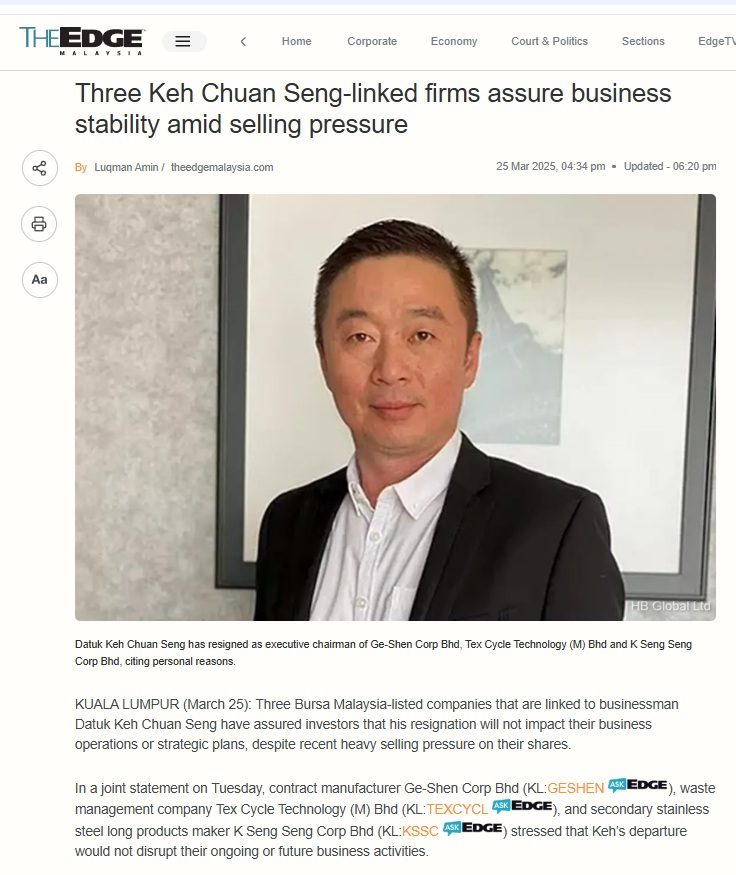

However, on 24 March 2025, Datuk Keh surprised the market by resigning from all his corporate positions simultaneously, citing “unforeseen personal circumstances.” Frazel Group Sdn Bhd (owned by Datuk Keh) and Enrich Signature Sdn Bhd (owned by Chin Hin) had often worked in tandem to secure controlling stakes in public-listed companies.

Following his departure, all shareholdings were reported to have been transferred to Chin Hin Group through Enrich Signature Sdn Bhd.

All this comes amid investigations into his alleged involvement in the MBI International scheme.

The abrupt move triggered a decline in share prices, forcing the companies involved to reassure investors that operations would continue as usual.

MBI Funds Flowing into Bursa

Sources revealed that more than RM200 million in illicit funds from the MBI scheme had been channeled by Datuk Keh into the stock market. The portfolio reportedly spans over 30 publicly listed companies, with 16 key firms already identified by TCS. The recipients of Datuk Keh’s money within these listed companies must now be investigated.

Investigation: Tracing the Illicit Funds

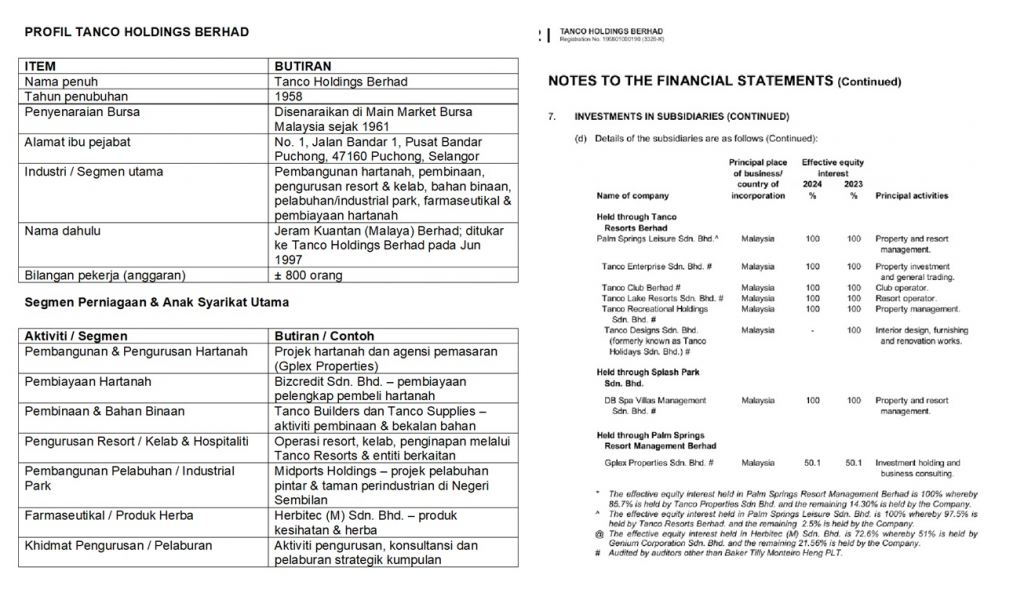

One of the most prominent companies in the spotlight is Tanco Holdings Bhd, where Group Managing Director Dato’ Sri Andrew Tan Jun Suan has become a target of scrutiny. He is alleged to have received an injection of funds originating from the MBI scheme to support operations and strengthen Tanco’s position on Bursa Malaysia – amounting to over 32 million shares valued at RM32.6 million. These illegal flows will undoubtedly be traced, and Andrew Tan Jun Suan may inevitably be implicated.

The Questions

- Has Tanco Holdings served as an investment vehicle to launder MBI funds?

- What is the true nature of the collaboration between Keh Chuan Seng and Andrew Tan?

- Who is the real founder of Tanco Holdings, and how is he linked to this network?

Who Founded Tanco Holdings?

For the record, Tanco Holdings Berhad was established in the 1920s as a small construction and property development company before being listed on Bursa Malaysia. The original founders were a group of local investors in the land development sector, before the company expanded through acquisitions and new capital injections.

Today, Tanco is known as a property and hospitality player, with projects in Port Dickson, Sepang Gold Coast, and other mixed developments. However, its reputation is now clouded by allegations that high-profile figures such as Andrew Tan benefited from the flow of illicit MBI funds.

Tanco’s latest venture is the construction of a port in Port Dickson, Negeri Sembilan, through a joint venture with the Negeri Sembilan Menteri Besar Incorporated (MBI-Incorporated). The project is estimated to cost RM2 billion, with Tanco partnering CCCC Dredging Group Co Ltd for port development and COSCO Shipping Ports Ltd for operations and management.

Tanco’s share price once surged to RM1.04 per share on 29 May 2025, a level last seen 27 years ago before the Asian financial crisis. The group made headlines with its ambitious Port Dickson port project in collaboration with MBI-Incorporated.

But the looming question remains: if Group MD Dato’ Sri Andrew Tan Jun Suan were to be arrested over alleged involvement in the MBI scheme, would Tanco Holdings Bhd’s shares suffer another blow?